The UK Autumn Budget is approaching, and logistics businesses across road transport, warehousing, ports and freight forwarding are watching closely. The sector is uniquely exposed to shifts in operating costs, taxation and infrastructure funding; This year’s Budget could influence investment decisions and supply-chain strategies well into 2026.

Rising Cost Pressures

Operating margins in logistics remain historically tight, and any Budget measures that increase core costs could hit profitability almost immediately.

Fuel duty is expected to receive significant attention. Fuel remains one of the largest direct costs for road haulage operators, and any increase in duty would directly raise transport rates and push inflationary pressures down supply chains. With consumer demand already softening in some sectors, many operators have limited ability to absorb increased costs.

Employer National Insurance and other employment-related charges are also a concern. Logistics is labour-intensive, particularly in warehousing and last-mile distribution. Any rise in employment costs risks exacerbating ongoing recruitment challenges and may accelerate investment in automation as an alternative to expanding workforce numbers.

Business rates for large distribution centres are another pressure point. Logistics facilities occupy significant square footage, and rate increases would disproportionately impact the sector — especially in high-growth logistics corridors around major ports, airports and motorways.

Potential Upside: Investment Incentives and Infrastructure

There is also cautious optimism. Recent policy direction suggests continued focus on infrastructure, supply-chain resilience and accelerating the shift to cleaner vehicles and more efficient transport networks.

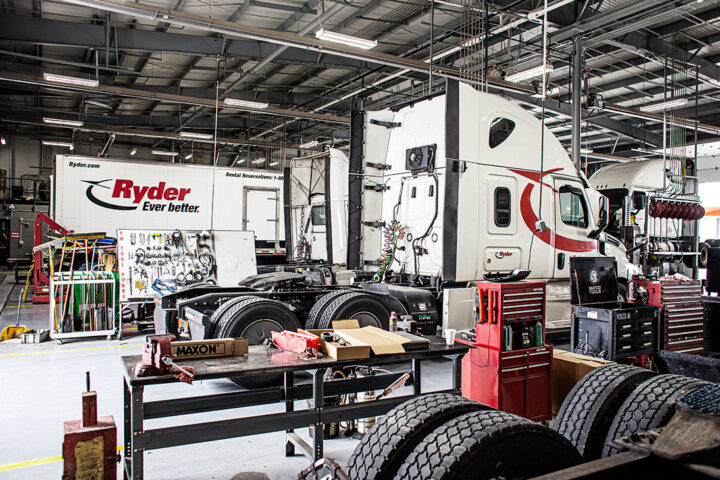

A continuation or expansion of tax incentives for capital investment, such as full expensing for plant, equipment and fleet purchases, would be welcomed. For warehouse operators, fleet owners and port operators, such measures help justify investment in automation technologies, loading solutions, storage systems and electric or alternative-fuel vehicles.

The sector is also hoping for clarity on long-term infrastructure funding, particularly around strategic freight corridors, road maintenance and port access improvements. Delays or uncertainty in infrastructure upgrades often cause inefficiencies that ripple through national supply chains.

If the Budget reinforces commitments to strengthening freight transport networks, it could unlock new capacity, reduce congestion-related delays and improve reliability in time-critical logistics segments such as pharmaceuticals, grocery and express freight.

Strategic Considerations for the Sector

The Budget is unlikely to deliver a single transformative policy; instead, its cumulative impact will depend on the balance between cost pressures and investment support.

Logistics firms are encouraged to plan proactively:

- Model different cost-increase scenarios, especially around fuel and employment-related taxes.

- Assess investment timing, particularly if fleet replacement, warehouse automation or decarbonisation projects are planned in the next 12–36 months.

- Monitor workforce planning to ensure competitiveness in a tight labour market.

- Stay engaged with industry bodies that advocate for infrastructure prioritisation and regulatory simplification.

The sector is also increasingly focused on decarbonisation strategy. If the Budget strengthens incentives for zero-emission HGVs, charging infrastructure or alternative fuel corridors, first movers could gain both operational efficiency and reputation advantage.