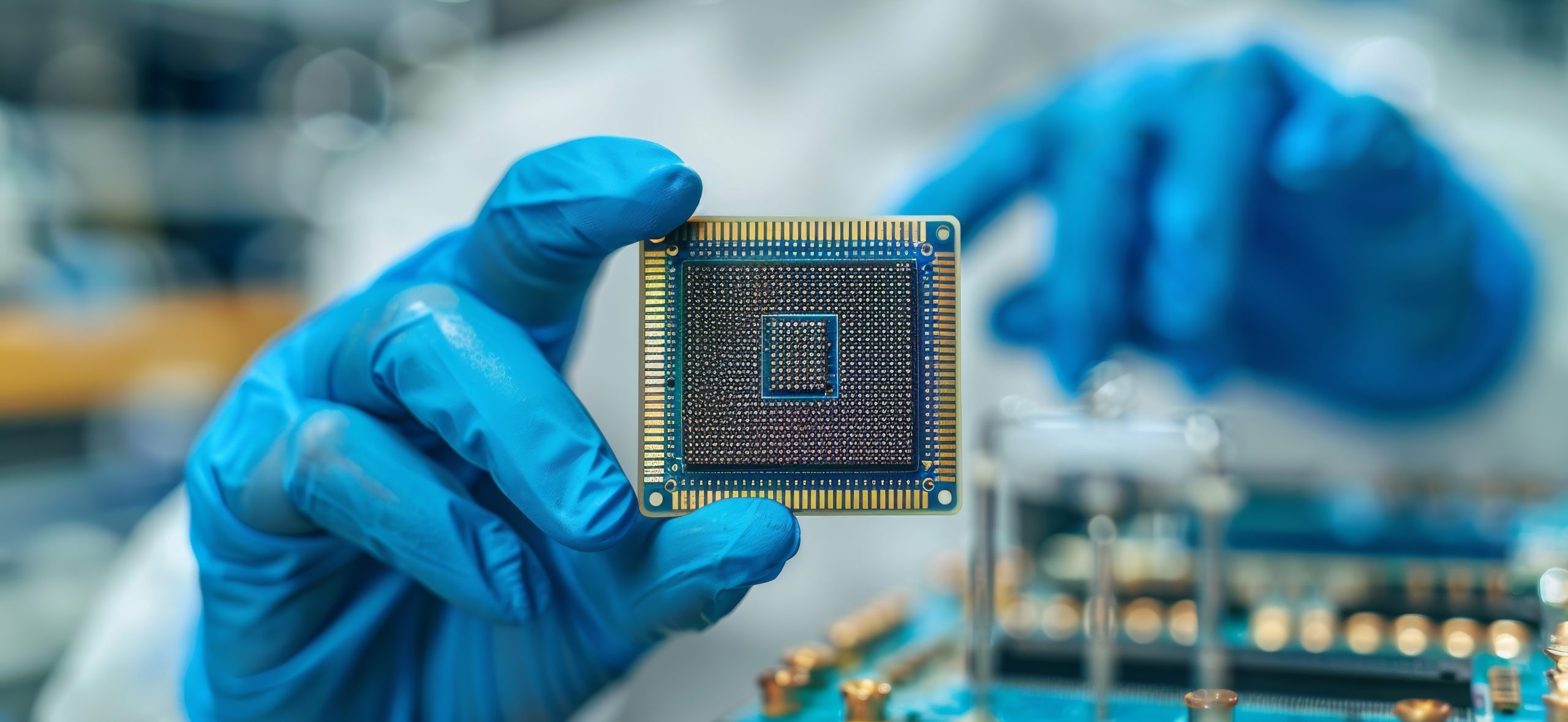

The European Union is accelerating efforts to reduce its reliance on China for critical raw materials, following renewed concerns over rare-earth export restrictions and their potential impact on Europe’s semiconductor and advanced manufacturing sectors.

Recent signals from China around rare-earth exports have sharpened focus on supply chain vulnerabilities, particularly as demand for high-tech semiconductors continues to rise. Industry experts warn these pressures are likely to intensify in 2026, bringing long-standing geopolitical, trade and material-dependency risks to the forefront.

Steffen Schulze Selting, Senior Director of Customer Success at Sphera, says the rapid expansion of artificial intelligence is driving semiconductor demand and raising the stakes for supply chain resilience.

“With the continued rise of AI, the demand for high-tech semiconductors is growing, and with it the requirements for resilient supply chains,… A potential conflict between China and Taiwan hangs like a sword of Damocles over the industry and global supply chains.”

The semiconductor sector remains particularly exposed to geopolitical tensions in the Asia-Pacific region. Any escalation involving Taiwan could trigger sanctions on China, with severe knock-on effects across global supply chains, far beyond electronics manufacturing.

Looking ahead to 2026, Schulze Selting expects companies to intensify scrutiny of their supply chains, examining dependencies and seeking alternative sourcing options. Governments and businesses are investing more in resilience, but export controls, restrictions on critical materials and changing trade relationships continue to limit flexibility.

European exporters are also expected to feel a stronger impact from U.S. tariffs in 2026 than in 2025. Last year’s effects were partly softened by front-loading, as companies shipped goods ahead of tariff increases. By 2026, that buffer will have disappeared, exposing exporters to higher costs without short-term mitigation options.

Despite these challenges, Schulze Selting points to more positive developments on the regulatory front. Greater clarity around European regulations in 2026 is expected to simplify administrative requirements and reduce costs for many businesses.

“Lessons are being learned from years of disruption… Risk management will be central to building resilience, with sustainability embedded into decision-making. Those who fail to act will ultimately lose market share.”