The Government’s latest Budget has landed with a thud in the logistics sector – offering some targeted relief, but also signalling upcoming pressures that many operators will find hard to absorb. As always, the devil lies in the detail, and the British International Freight Association (BIFA) has been quick to dissect the impact on freight forwarders, supply-chain operators and international traders.

From our vantage point, the message is clear: there’s help on the table, but the long-term picture remains challenging.

Fuel Duty Cut Extended – a Welcome, If Temporary, Lifeline

One of the headline positives is the extension of the 5p fuel-duty cut until August 2026. For hauliers and transport operators still battling high operating costs, this brings essential short-term relief.

But the mood is tempered by what comes next. The Budget confirms a gradual reversal of the cut from September 2026 – something BIFA describes as “deeply worrying.”

And rightly so: fuel remains one of the most volatile cost lines in logistics, and any increase reverberates across the entire supply chain.

Full Expensing Helps Investment Plans Take Shape

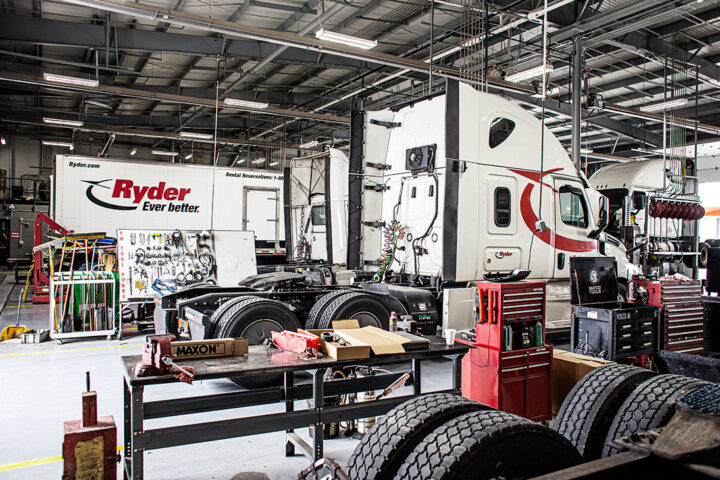

Investment incentives, especially the continuation of full expensing for capital investments, offer a boost for fleet renewal and modernisation.

In a sector where ageing vehicles, decarbonisation pressures and infrastructure needs all compete for funding, this measure will help companies move forward with long-delayed upgrades.

We’re already hearing from operators who say this incentive could accelerate their shift towards lower-emission vehicles and smarter warehouse technologies.

De Minimis Abolition: Levelling the Field, But Raising Headaches

The Government’s decision to scrap the £135 “de minimis” import exemption aims to remove an imbalance that has long frustrated UK businesses. Cheap imports from overseas sellers have enjoyed a competitive edge – something this change will address.

But there’s another side to the coin. Removing the threshold increases customs declarations, duties and processing requirements, particularly in small-parcel and e-commerce logistics.

BIFA notes this could bring new business to customs intermediaries, but also warns of additional burdens and potential disruption.

From our perspective, the 2029 implementation date is crucial – without that runway, the impact on parcel carriers would be severe.

Northern Ireland Support Package Brings Much-Needed Stability

The logistics industry will also welcome the new “Internal Market Package” and additional financial support for firms operating between Northern Ireland and Great Britain. Post-Brexit trade across the Irish Sea has been anything but straightforward.

BIFA says this support is “welcome”. Anything that reduces friction in this corridor boosts consistency, planning and cost predictability.

SPS Changes Could Reduce Red Tape

The Budget also reflects updates under the UK–EU SPS (sanitary and phytosanitary) agreement. These changes aim to streamline checks on food, agricultural products and other goods requiring regulatory oversight.

If delivered effectively, this could speed up cross-border freight and lower compliance costs.

Operators handling temperature-controlled goods will be watching closely – even minor improvements here can prevent costly delays.

Wider Taxation Pressures Could Suppress Trade

While logistics-specific measures are mixed, the broader economic context raises concerns.

Rising employer costs, frozen allowances and wider tax increases could reduce consumer spending and therefore reduce the volumes flowing through UK supply chains.

This is the part of the Budget that often gets overlooked – when the end consumer tightens their belt, logistics feels it first and last.

Preparation Time Helps, but Uncertainty Remains

BIFA has welcomed the fact that several major changes – including the de minimis removal – will not take effect immediately. This gives operators time to prepare structurally and financially.

The association has also reiterated its willingness to work with Government to ensure the industry can adapt effectively.

From our editorial viewpoint, the real question is whether the sector will have enough bandwidth to adjust to these changes while also contending with recruitment challenges, high operating costs and the continuing march toward decarbonisation.